Do your supplier payments cost or make you money? Instead of allocating expensive engineering time to build and maintain a solution for international multi-supplier payments, you can take the technical complexity out of the equation while automating manual reconciliation, optimizing currency exchange, mitigating fraud risks, and making more money with rebates. How? Virtual payments with an effective orchestration engine.

At Sabre, we’ve built a comprehensive virtual payments solution to streamline operations, improve security and compliance, and keep your cash flowing. Read on to explore the drawbacks of existing payment methods, the benefits of virtual payments, the role of an orchestration engine, and how OTAs can get more from supplier payments with Sabre.

- Current payment options aren’t fit for purpose

- Virtual payments are the way to go

- Optimize virtual payments with an orchestration engine

- Get started quickly with Sabre Direct Pay

Current payment options aren’t fit for purpose

Your engineering team is busy. Managing supplier payments is another challenge to consider in addition to delivering exceptional travel customer experiences. However, traditional supplier payment options aren’t fit for purpose for modern OTAs that need to scale fast, access deep data insights, and provide seamless customer experiences without relying on manual operations. Here are a few payment methods and the challenges they present:

- Customer credit card. Passing customer credit card details directly to suppliers for them to process rather than accepting payments yourself can confuse customers when merchant details on their bank statements don’t match the OTA platform and when payments are split between multiple suppliers.

- Cash payment. This method provides no cash flow which is particularly pertinent for bookings taking place months in advance. It also limits rebate opportunities for OTAs.

- Bank transfer via invoice. This complicates treasury management and payments are rarely integrated into existing workflows, limiting the amount of aggregated data, and making manual reconciliation more difficult.

In addition to contending with traditional payment methods, you face both business and technical challenges to ensure seamless, cost-effective supplier payments.

Business challenges

- Missed revenue and cashflow opportunities. Managing rebates, surcharges, and processing fees across payment providers and methods is a balancing act that can restrict your cashflow and leave you paying more than you need to and missing income opportunities.

- Operational overload. You can’t scale if you face internal hurdles when finance team members are overwhelmed with manual processes, reconciliation, and reporting, particularly during peak times.

- Restricted international expansion. To grow your business across countries and regions, you need to build and maintain relationships with global providers and consider effective currency conversion to avoid costly exchange rates.

- Regulatory compliance. Navigating the payments landscape requires following evolving regulatory compliance standards, notably PCI DSS globally and EU’s Payment Services Directive (PSD2) in Europe.

- Risk of supplier bankruptcy. You face an inherent risk with financial stability of suppliers, making you potentially liable for refunds or facing unrecovered funds. You also face an increasing threat of fraud that opens you up to lost revenue, breeches of regulations, and fines.

Technical challenges

- Systems integration. Traditional payment systems need significant upfront integration and ongoing maintenance to ensure seamless data flows with existing OTA infrastructure.

- Industry know-how. You need to stay up to date with the intricacies of international industry compliance, best practice, and international nuances across the sprawling payments ecosystem consisting of banks, payment gateways, card networks, fintech providers, and more.

- Limited data insights. Manual processes, poorly connected systems, and siloed data make it difficult to understand performance and make decisions to improve operations.

- Build vs buy decisions. Building your own payment solution gives you flexibility but the resources needed to develop and maintain the infrastructure in addition to orchestration and reconciliation layers shouldn’t be underestimated.

Virtual payments are the way to go

OTA tech leaders who prioritize virtual payment solutions can alleviate the challenges of traditional payment methods and improve security, compliance, processing times, and transaction tracking and reporting.

Virtual payments aren’t new – they’ve been around since the mid-2000’s – but OTAs are increasingly adopting this method to pay suppliers as they’re under pressure in today’s competitive marketplace to optimize revenue opportunities, automate processes, offer greater data insights, and operate at a global scale across regions and currencies. You can unlock these benefits with Sabre Direct Pay:

- Grow revenue and lower costs. Improve your cashflow by paying suppliers at optimal times, maximizing rebates, avoiding surcharges, and using the best payment method for each transaction.

- Automated operations and data reporting. Process payments faster and save your finance team days usually spent on manual processing, reconciliation, reporting and data interrogation with automated workflows.

- Support for international growth. Process transactions for global suppliers and optimize currency exchange fees by matching virtual cards to the most appropriate supplier account and payment gateway.

- Improved security, compliance, and protection. Your money is safe with strict PCI DSS compliance protocols including penetration testing to protect payments in addition to rules-based transaction authorization and travel-specific spend categories and merchant codes to mitigates the risk of fraud.

- Faster integration and easier maintenance. Cut technical integration time from months to as little as four to six weeks without needing to build and maintain dozens of technical connections with payment gateways, card issuers, banks etc. Then empower your finance team to manage business rules themselves within the user interface without intervention from your engineering team.

- Leverage payments and travel industry expertise. Access Sabre’s deep knowledge of the travel and payment industries and relationships with global payment providers without needing to train and hire internal experts or build your own industry connections.

Optimize virtual payments with an orchestration engine

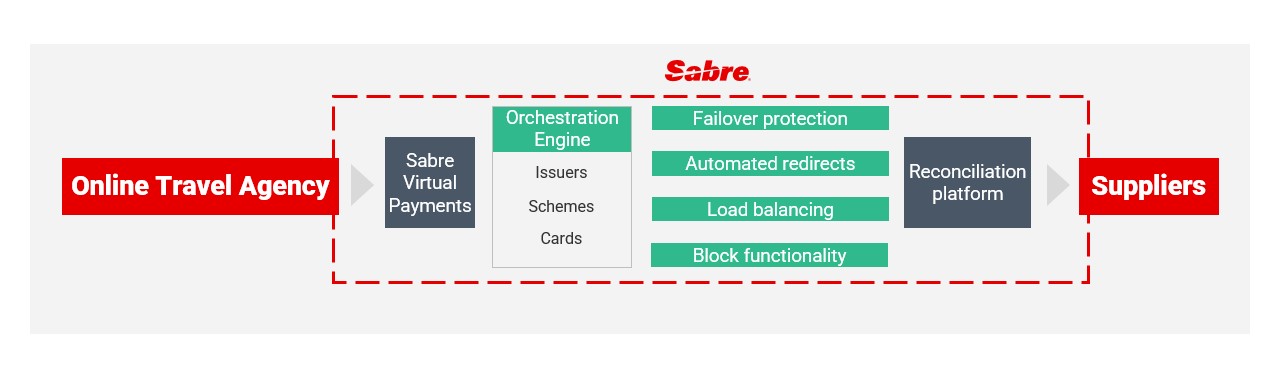

An orchestration engine is the key to effectively managing supplier payments. It’s a core function of Sabre Direct Pay that intelligently routes payments across issuers, schemes and cards based on spend type, supplier ID, supplier amount, currency and more. By using a ready-built orchestration engine with associated reconciliation platform, you’ll benefit from seamless payment processing with failover protection, automated redirects, load balancing, and block functionality.

Failover protection. When a payment gateway or card issuer fails due to software bugs, infrastructure outages, or other unforeseen problems it can lead to transaction failures or delays, lost revenue, and an erosion of trust. These instances typically need manual intervention from OTAs to identify and reissue missed payments. Failover protection is a safety net, intelligently routing payments between issuers, products, and accounts. This redundancy minimizes downtime and ensures resilience so you don’t miss payments that can cause late payment fees or lost rebates.

Automated redirects. Suppliers often need to be paid to or from specific accounts to maintain relevant budget allocations, leverage financial benefits with banks, or manage currency-specific transactions. Automated redirects based on predefined criteria makes sure your payments are accurate and compliant with financial policies without the need for manual interventions which take time and can introduce human error.

Load balancing. To meet specific contracting obligations or hit spend targets with issuers get the best rebates, you need to strategically distribute payments. Loads can be assigned based on revenue, interchange, funds available (credit/debit), and card types. The weighting across the payment ecosystem can be updated in the user interface in just a couple of minutes to maximize revenue opportunities.

Block functionality. You need control over your payments to avoid breaches of contract or internal OTA policy. For example, blocking payments to specific regions due to sanctions or ensuring adherence to internal spending limits. Block functionality allows your finance team to set specific restrictions or rules, preventing unauthorized or non-compliant transactions to safeguard against potential financial and legal repercussions.

Get started quickly with Sabre Direct Pay

Instead of investing engineering time into maintaining a technically complex payments platform with evolving security, compliance, and risk considerations, you can access a ready-built solution to meet ambitious growth needs.

Why Sabre Virtual Payments? You get more than other solutions: 50+ currencies, 90+ countries, top 5 global card schemes, and 70+ banks. Get in touch with Sabre payments experts today to explore how you can quickly integrate the solution into your tech and payments stack to reduce complexity, consolidate reporting, streamline workflows, and make more money from rebates.

About the Author

Nicolas Ortiz Luengo (Director, Product Management, Payments) leads the Sabre Direct Pay product team, responsible for delivering a comprehensive payments platform that streamlines agency operations and optimizes revenue on every transaction.

Discover more

Stay in touch

Fill out the form below and be the first to know when we release new blogs.